Green investment loan

The Green Investment Loan is our way of supporting sustainable investments of small and medium-sized enterprises to create environmentally friendly and socially responsible businesses.

-

Energy efficiency

-

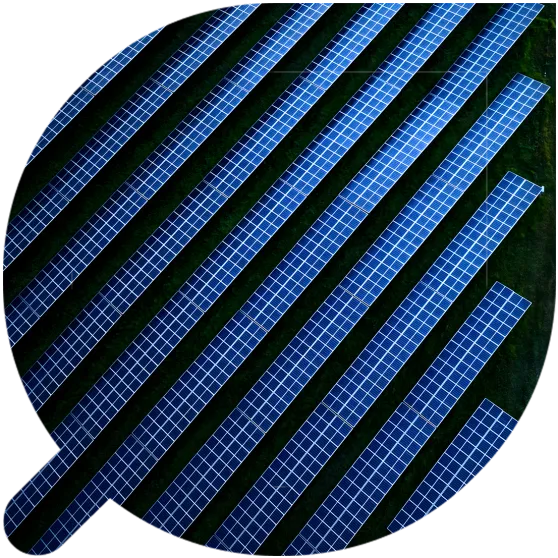

Renewable energy

-

Environmentally friendly measures

Product Parameters

Our methodology is described in the ProCredit Green Bond* and, in summary, it allows the following projects:

Energy efficiency

Reducing energy consumption while maintaining or increasing production levels. Based on calculations of machine productivity, we look for at least 20% higher efficiency compared to the machine being replaced in the company, or 20% more efficient compared to alternative new models available for sale in the country.

Such projects may include:

-

Solar photovoltaic panels or solar collectors for hot water.

-

Heating, ventilation, and cooling systems. Boilers and heating appliances, air conditioners, refrigeration and freezing chambers, centralized ventilation systems.

-

Building management systems, lighting, automation.

-

Improvements in thermal insulation or windows of buildings – new windows, new or additional thermal insulation.

-

Transport or agricultural machinery – tractors, combine harvesters, drip irrigation systems, sprayers, etc.

-

Electric vehicles and infrastructure for their charging.

Renewable energy

For the production and/or use of energy resources that are inexhaustible or can be replenished quickly.

Examples of such investments include:

-

Solar photovoltaic panels or solar collectors for hot water.

-

Solutions using geothermal energy for heating and cooling.

-

Systems for generating energy from biomass and biogas.

-

Hydroelectric power stations or wind turbines, after conducting an Environmental Impact Assessment (EIA) according to the Bank's criteria.

Measures with a positive impact on the environment

They have a direct positive effect on nature and resource preservation.

Such activities and investments may include:

-

Recycling and waste management (excluding landfills) – working capital for businesses engaged in such activities or investment loans for purchasing machinery for this purpose.

-

Treatment facilities – filters, water purification systems, etc.

-

Organic production – the measure may include working capital financing, certification costs, and expenses for new equipment to change the soil cultivation method.

-

Afforestation, reclamation of disturbed lands, and other similar activities.

-

Investments and activities clearly related to the circular economy, where 100% of the resources used are already recycled.

-

Suppliers, auditors, and others related to providing services in this area can be financed with working capital.

Advantages

Additionally, we offer specialized targeted loans with an environmental focus:

*The Green Bond of ProCredit Holding is structured in line with the Green Bond Principles and positively validated by an external evaluator, Sustainalytics.

Annually, all employees of ProCredit Bank Bulgaria participate in training on responsible lending, the environment, and the solutions available through green investments. Since 2013, all front-office employees have additionally participated twice a year in training on how to recognize, communicate, and promote the application of environmentally friendly solutions with our business clients.

The bank has internal engineering staff in the "Sustainability" department who assess the effectiveness of specific investments. For all investments with clear quantitative indicators, carbon (CO2) savings are calculated.

For most positions, the criteria align with the technical criteria of the European Taxonomy, as well as those of the European Bank for Reconstruction and Development (EBRD), the European Investment Fund (EIF), the European Investment Bank (EIB), and others.